Logistics Technology Trends That Will Dominate 2017

/Making predictions in technology, even just one year out, are generally an exercise in futility, so this really isn't a forecast for 2017, but more a list of trends that I am interested in and keeping my eye on. Technology is rarely released according to plan and surprises can come from many directions. However, it makes sense to keep tabs on what’s coming and it's also great fun to think about what’s coming next. Here's what I will be looking out for in 2017:

Automation and Robots

eCommerce has revolutionised shopping, but due to the complexity of picking eCommerce orders, retailers need to employ armies of workers to get orders out the door. In the U.S., Amazon alone hired 120,000 temporary workers over the holidays in 2016. The manual picking of orders is simply an expensive bottleneck where no value is added and thus an obvious target for automation.

Amazon has their own Robotics division, formally Kiva Systems, and they host an annual robotic picking challenge where robots perform real-world tasks of picking orders and restocking shelving. In the 2015 competition, the best robots were picking at a speed of 30 items per hour (very slow compared to humans). In 2016, however, in a much tougher competition the robots were picking roughly three times faster at 100 items per hour. Will we see a similar rate of improvement in the next Amazon picking challenge which would put the robot picking speed closer to humans? And even though it’s probably still a few years off before the speed and accuracy are on par with humans, the future is clear.

Self driving Vehicles

In 2016 there seemed to be a new story every week about self-driving cars. Ford announced plans for self-driving cars, Uber launched trials in Pittsburgh and San Francisco, acquired self-driving truck startup OTTO, Google spun off their self-driving car group into Waymo, and Elon Musk wrote his Master Plan Part Deux on self-driving cars. In addition, a self-driving OTTO truck completed the first autonomous commercial delivery in the U.S foreshadowing the potential of self-driving trucks in logistics. 2016 made it crystal clear that fully autonomous self-driving cars and trucks are no longer the realm of sci-fi fantasy. The software and hardware is available now.

As self-driving vehicles are getting closer every day, the big question in 2017 will be in regards to the regulatory and governmental support of the technology. Trials have already started in the U.S., China, Singapore, and Sweden. Which country will take the lead and have the political will to push self-driving vehicles forward in 2017?

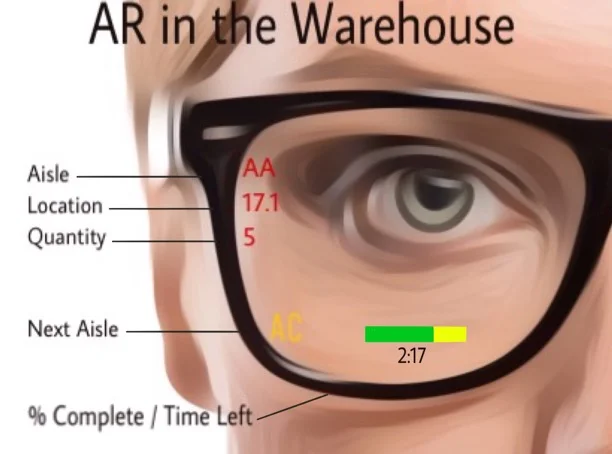

Augmented Reality

The Pokemon Go phenomenon, which has exceeded 500 million downloads worldwide, highlights the possibilities of augmented reality (AR) not just for gaming, but also for use in the supply chain. AR is a technology that superimposes a computer-generated sensory input such as sound, video, graphics, or GPS data into a user’s real view of the world. AR is rapidly becoming an important technology in the enterprise, bridging the divide between the physical and digital world. ABI Research forecasts that AR will hit an inflection point in 2017 and grown by more than 400% over 2016. In Logistics, DHL has piloted AR in Europe and the United States, equipping warehouse workers with AR smart-glasses that guided them through order picking. AR can be beneficial to any deskless worker who needs hands-free access to contextual information which opens up the potential use cases immensely in Logistics. Benefits include higher efficiency, reduced errors, reduced training, and an optimized use of labor. AR’s primary technical challenge are performance, battery life, size and weight to make it practical for day to day use. Most analysts agree that these technical barriers will be broken down within the next few years. How the technology advances in 2017 may drive the broader adoption in Logistics.

Amazon and Logistics

Amazon made waves in the industry in 2016 with a series of moves that illustrate that it is serious about getting into the logistics business. Amazon leased 20 cargo planes to deliver goods to and from fulfillment centers, registered as an ocean freight forwarder in China, hired former CEO of the freight forwarder UTI Worldwide, as Vice President of Global Logistics, and built an ‘Uber for Trucking’ app to match truck drivers with shippers. Amazon has also been adding sortation centers that receive shipments from Amazon’s fulfillment warehouses where packages are sorted by postcode and then are delivered to the USPS for last mile delivery, cutting out the need for UPS or Fedex. While in the short run, these moves could be interpreted as a way to rein in shipping costs and provide increased capacity during peak periods, it has become increasingly clear that Amazon is searching for ways to lessen its dependence on 3rd party carriers and take control over its logistics network. How fast will Amazon expand into logistics in 2017 and what will be the impact on logistics providers?

On-Demand Delivery

Uber’s success in disrupting transportation has led to enormous VC funding of “Uber-for-X” businesses where smartphones are used to connect customers with nearby workers on demand. A number of startups have entered the same-day / same-hour delivery market with the intent of fundamentally transforming how we shop and eat. Rapid on-demand delivery combines the convenience of ordering from anywhere with the immediate product availability of traditional bricks and mortar retail stores. Convenient and low cost same-day delivery is emerging as the next logical paradigm in retail and will gradually become the expectation for many consumers. The rapid delivery trend coupled with the global shift to on-demand consumption has led to a massive funding of delivery startups. But, has there been too much money given to these startups? In 2017, I am looking out for consolidation and acquisitions of existing on-demand delivery startups.

Also, will Amazon or Uber make further strides in this space? Amazon’s biggest threat in the U.S. may be Uber providing a platform for traditional brick-and-mortar retailers to offer rapid delivery and win back customers who have migrated to Amazon. How this dynamic plays out over the next few years will be fascinating.

The Wildcard: President Trump

Donald Trump was elected, in part, by talking about how American manufacturing jobs moved overseas as plants closed down and moved overseas. He has made numerous threats about U.S. Companies manufacturing overseas, NAFTA, and the Trans-Pacific Partnership that indicate that he’s serious about transforming how the U.S. does business globally. What Trump says and what he does, may be two different things, but there is certainly the potential for a large impact to global trade. Will supply chains become less dependent on distant, low-cost labor? If so, will manufacturing jobs come back or are we more likely to see plants producing small lot sizes and using heavily automated production. Will we see a decrease in trade in 2017 with China and Mexico? Since Trump is a wildcard, who knows what he will do, but I think it’s fair to assume that global trade will be different to what we’ve seen from both Republicans and Democrats in years past and this will have a flow on impact to technology.

I cover forward-looking topics that are relevant for everyone that will be part of the future logistics industry. You can read more articles here or sign-up for a free monthly newsletter here.