Covid-19 and the Rapid Acceleration of Online Commerce

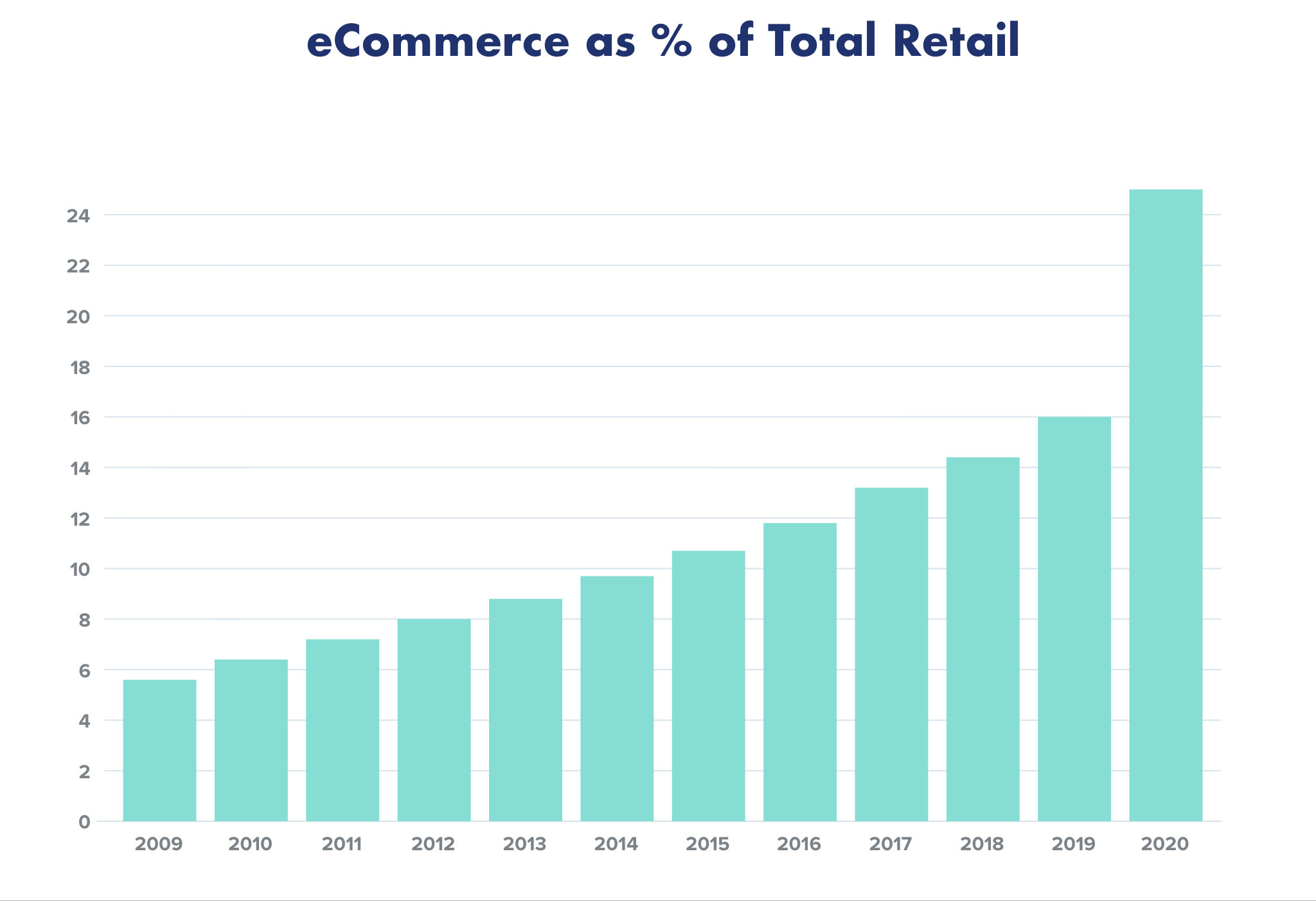

/Over the last ten years, online shopping has experienced slow and steady growth from a relatively small group of consumers who frequently shopped online. As a percent of total retail sales, online shopping has increased about 1% per year to 16% of total retail sales in 2019. It’s been a clear trend that was widely expected to continue sustained, albeit somewhat slow growth.

Fast forward to 2020, and to see how Covid-19 is reshaping purchasing habits, you can probably just look at your credit card statements and the packages or meals turning up on your doorstep. Recent UBS analysis predicts that online shopping as a percentage of total retail could rapidly increase to 25%. That’s about 7-10 years of growth compressed into a few months. No one could have predicted this.

Source: U.S. Dept of Commerce, UBS

Retail Stores

Physical Retail stores have always provided a combination of discovery (finding products in a store), recommendations and service (knowledgeable sales people), and logistics (all this stuff centralized in one store). Discovery and Logistics both convert very well to online shopping. Amazon offers a near infinite selection to the smartphone in your pocket at the click of a button and delivers to your door within a few hours. Recommendations and Service can’t be handled as well (yet!) by online shopping, especially for experience retail like Warby Parker or Restoration Hardware. However, most everyday purchases don’t need recommendation and service.

With many physical retailers already struggling pre-Covid, retail bankruptcies increasing and more people realizing that you simply don’t need to go to a physical store anymore, momentum continues to build for online shopping and it’s not that hard to imagine that many of these retailers will never come back. Online remaining at 25% of total retail coming out of Covid-19 feels sustainable.

Groceries

The penetration of online shopping for groceries has always been very low compared to other retail sectors - in the neighborhood of 2-3%. This could be explained by people wanting to pick out their own fruit and vegetables or just not wanting to pay additional delivery fees. Post-Covid, with the need to don a face mask and frequently sanitize your hands after touching anything has changed the calculus. Tesco, a U.K. Supermarket, has doubled the number of orders they deliver in a week to 1.2 million. Instacart has seen sales rise 500% year over year and are seeking another round of funding that would put their valuation between 12 and 14 billion, a 50% increase over the last funding round in 2018. Does online grocery go from 2% to 10% and never go back? Covid-19 combined with AI and voice technologies could quickly accelerate online grocery.

Restaurants

Restaurants have been forced to move to delivery and takeaway only and primarily sell meals via one of the delivery platforms like Uber Eats or Grubhub. For the restaurants, this comes at a cost as their margins shrink due to the delivery platforms taking 20-35% of the meal price. It’s also more difficult for the restaurant to sell higher margin items like alcohol and appetizers.

Post Covid, will restaurants be able to make their rents with potentially smaller crowds and socially distanced seating or will they shift to a delivery only model? Will it be economically viable for restaurants to remain with large in dining seating areas? Or, will some restaurants permanently move to a dark kitchen model where multiple restaurants prepare meals in a shared space for delivery only?

After Covid-19 is under control either with treatment or a vaccine, will the delivery of meals, products, and groceries have been accelerated so fast that many physical retail shops and restaurants simply not be there anymore? Will the reduced supply of physical options permanently shift a large percentage of demand to online commerce?

I cover forward-looking topics that are relevant for everyone that will be part of the future logistics industry. You can read more articles here or sign-up for a free but shockingly infrequent newsletter. When will it arrive in your inbox, who knows!