Who will Own Same Day Delivery: The Case for Uber

/This is the second in a series of posts on same day delivery. You can the read the first post here.

Source: Uber

In the previous post I highlighted a handful of the emerging on-demand same day delivery startups and the complexities inherent in building a 3-sided marketplace. In addition to these startups, I wanted to do a deeper dive on two non-traditional logistics companies that are approaching same-day delivery from different angles and could be well-positioned to be market disruptors for same-day delivery. They are of course Uber and Amazon; Uber has a first mover advantage via their existing ride-sharing platform. a deep and re-purposable delivery fleet with optimised routing algorithms combined with the ability to raise enormous capital. And then you have Amazon, with their ability to move into adjacent businesses, their relentless focus on the customer, and their willingness to get into new markets at razor thin margins. This post will focus on Uber.

Network Effects and Geographic Density

Uber’s potential in same-day delivery can best be explained by the presence of network effects in ride-sharing, that is, more drivers on the network attract more riders and vice versa. Uber’s values is dependent upon these network effects. The more drivers in an area leads to faster pick-up times, which leads to a better customer experience, which leads to more demand, which leads to more drivers, and more profits for drivers.. It’s a virtuous cycle best summed up by David Sacks tweeted napkin drawing:

Source: David Sacks

Parcel carriers also rely on geographic density to drive down the costs of delivery. Parcel carriers can get last mile delivery costs down to $1.50 - $2.00 per stop. Parcel carriers have one driver dedicated to cover a cluster of neighborhoods and can provide fixed once daily pickups and deliveries. This leads to overwhelming route density for the duopoly of UPS and FedEx in the USA and prevents new entrants from entering the market. An interesting and potentially game-changing distinction in Uber’s case, is that they could provide a driver on every street within a few minutes as opposed to once daily which is an incredibly powerful enabler for economical same day delivery.

Uber and the Last Mile

In 2013, Uber made their aspirations abundantly clear of not being just a car service by changing their tagline from “Everyone’s private driver” to the broader “Where lifestyle meets logistics.” Uber’s goal is for logistics and transportation to become a utility where the movement of people and parcels are optimized and perhaps some day done autonomously. With logistics as a utility, Uber sits in the middle and collects a piece of every transaction - whether it's a rider or a parcel.

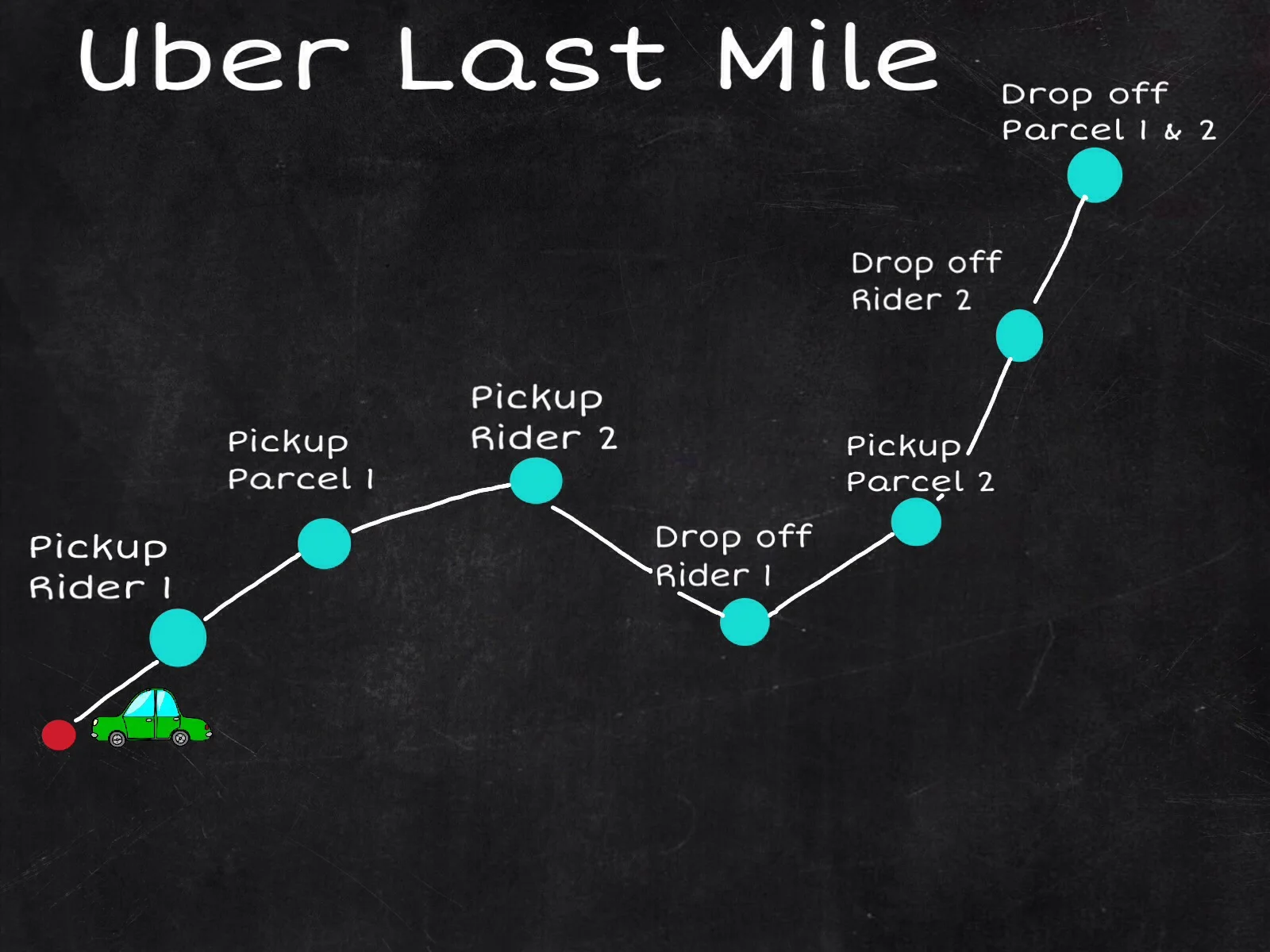

But what could on-demand delivery look like with Uber at the center of it all? In order for Uber to provide a winning value proposition to retailers and customers alike, they need to be able to pick up the parcel efficiently, deliver to the recipient at the time and place they want, and protect the retailer's brand throughout the process. Leaving costs aside for the moment, Uber package deliveries could be similar to their existing UberPool model where riders share a ride with others headed in the same direction, and could look something like this:

A couple of takeaways:

Do (or will) the economics of this model make sense?

Do customers want a uniformed parcel delivery carrier or are they OK with a random Uber driver?

Can the pickup and drop-off of packages be made as seamless as picking up or dropping off additional riders? If the answer is no, (which I suspect it may be especially for the drop off of a package) the experience for riders may not be so great.

Another possibility would be a highly localized “hub-and-spoke” delivery network akin to how parcels are routed through parcel carrier networks. In the localized version, many Uber drivers pick up parcels in between passenger pick ups and drop offs. These Uber drivers do not make the final delivery, instead they drop off to a centralized local hub which may cover a single postcode.

From the hub, specialized couriers and drivers make the final delivery.

A couple of takeaways:

Uber drivers pick up riders and packages but do not make final package deliveries thus not disrupting the rider experience.

Uber could partner with local stores to serve as secure drop off and pick up hubs.

This model enables specialized Uber couriers and drivers to be associated to a hub and perform all local deliveries which would satisfy a retaIler's demand for brand recognition and provide driver familiarity by repeatedly visiting the same area.

The routing algorithm, while still exceedingly difficult, is greatly simplified by having a hub.

Ultimately, consumer demand for rapid same-day delivery and simple economics will drive the evolution of same day delivery. Time will tell, and maybe same-day remains a niche option, but If same-day delivery is the next logical paradigm in retail, Uber has a significant first-mover advantage with a multi-year head start and I find it extremely hard to believe that on-demand startups will be able to compete with Uber. Through Uber’s existing ride sharing business they have the majority of the complications already figured out - route density, fleet optimization, traffic data, population flows, brand recognition, payments, a customer interface, 40 million active users, and the ability to raise enormous capital. In addition, Uber is taking the long view - heavily investing in self-driving cars, paying $680 million for self-driving truck startup Otto, and poaching a large number of Carnegie Mellon researchers.

For these reasons, if you are an on-demand delivery startup that I highlighted in this post, you should be worried, very worried. Some comparisons can be made with Amazon’s entry into the early days of online shopping. Both companies were operating in relatively uncharted territory, both were criticized over regulatory issues, and Uber, like Amazon, is willing to aggressively pursue market share at the expense of profitability. It has worked out for Amazon, and I like Uber’s chances.

I cover forward-looking topics that are relevant for everyone that will be part of the future logistics industry. You can read more articles here or sign-up for a free monthly newsletter here.